We recently had the chance to catch up with Josh Owen – President of Ability/Tri-Modal, a third generation privately held trucking, warehousing and distribution company that has serviced the Southern California gateway for international cargo since 1947.

We asked Josh how things have been going for his company this year and how 2011 is looking for the trucking community.

Here’s what he had to say:

PierPASS: When we last spoke, you had seen an improvement in truck congestion at the ports of LA and Long Beach – tell us about the changes you’ve seen.

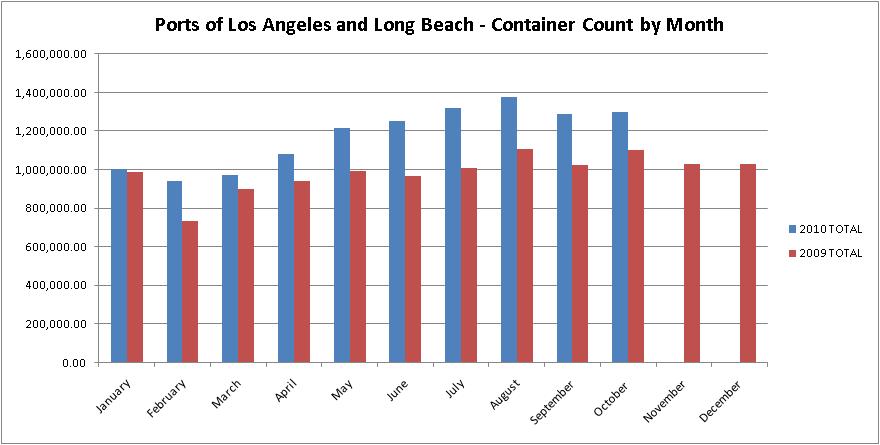

Josh: We really got hit this summer with higher cargo volumes – congestion was bad. When you look at the cargo volumes from last year, we really started to see an increase beginning in April, which peaked in June with a 36% increase in volume over 2009. This really caught the shipping and trucking companies, ports and terminal operators off guard.

But we’ve seen great improvements lately and congestion has really leveled out at LA and Long Beach. Terminals have returned to five OffPeak shifts, reinstated continuous operations through the lunch hour and expanded hours by adding back flex gates during those congested times.

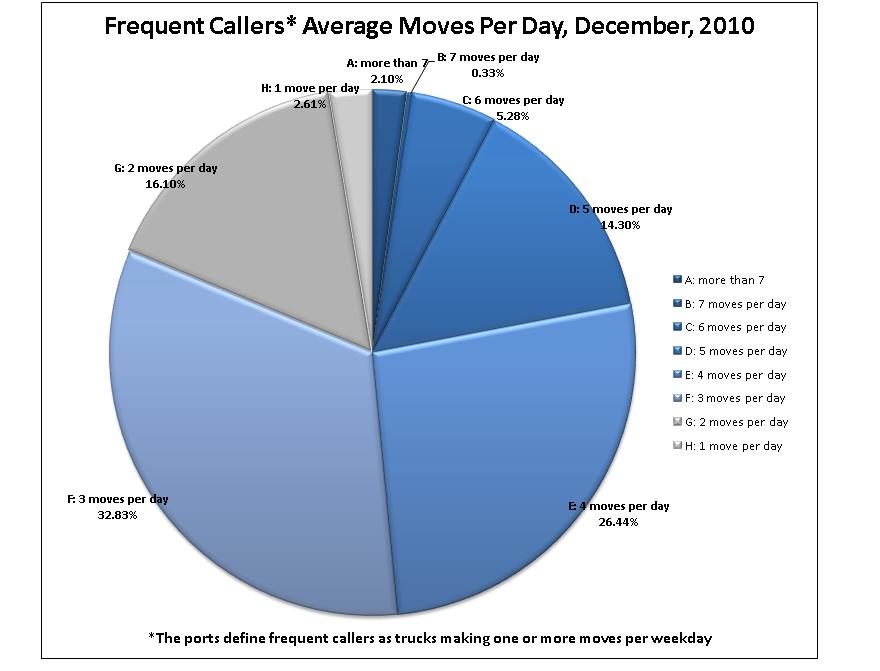

My company saw a jump from 1.9 turns (pickups or deliveries) in June to 3.6 – 3.9 in August. That’s huge. The best gauge that I have that things have gotten better is that I don’t hear my dispatch complaining that much! The latest I hear is that we’re now running out of warehouse space, which is a good thing.

PierPASS: How have issues of congestion affected business for the trucking industry this year?

Josh: This past year has really been a learning curve for all of us and has forced the community to come together and discuss solutions to issues that affect all of us. I think the formation of the working group I’m currently co-chairing with PierPASS has helped remedy some of the issues we’ve been faced with this past year. Now we have positioned ourselves to have open lines of communications and have a process in place so we can work together from now on – in good and bad times.

PierPASS: Tell us more about the working group – what are some of the topics or issues you are focusing on now?

Josh: The surge in cargo volumes and increased congestion of the ports has really pushed us, as a community, to look to the future and plan ahead for these dips and lulls better than we have in the past. One of the concerns of the future is if we do have a dip in cargo volumes again, that the same issues will resurface again if we handle the situation the same as we did last year by closing gates. We need to plan ahead for future slumps as well as future increases to ensure continued productivity at the ports.

PierPASS: How did the cargo volume during the 2010 holiday shipping season compare to 2009?

Josh: It is definitely up this year, but that’s because everything is. The peak season came really early this year– in May, June, July – following retailers’ needs to replenish their inventories after demand picked up post-2009. I think everyone now is very cautious to see how the buying season goes. There is so much at play in the retail world. If retailers aren’t doing well, we aren’t doing well.

PierPASS: What is your outlook for the industry – and your company – in 2011?

Josh: if I can predict what we can expect next year, I would! I think we need to be patient moving forward. Measuring growth is really accomplished by looking in the rear view mirror. Let’s give it two or three more quarters to see how the midterm elections, the housing market and unemployment rates affect American’s buying patterns. If people don’t have homes, they won’t be buying the furniture that comes through our ports.

We also have to factor in that there are going to be big changes in power in the Committee on Transportation and Infrastructure, which will have a huge impact on the transportation infrastructure.

The safe bet is to be cautiously optimistic.